Evolution of customer values: The blue ocean strategy

Evolution of customer values: The blue ocean strategy

In today's market, we are flooded with all kinds of products and services. With the development of information technology and a global economy, the pace of product development and cost reduction is accelerating. You could have a top-notch product with high customer value, and therefore high customer appreciation, and your product could have a considerable lead in the market this year. But very quickly you will encounter competitors mushrooming, and soon there will be many similar products on the market with reasonably good quality, similar product features and crazy prices. You'll be forced into a bloody, head-to-head competition to compete on every element of the client's current values. You will be forced to make improvements on every element of the customer's current values, while reducing prices. With this brutal competition, your profit margin will start to disappear.

This scenario is very common in today's market in the food industry, automobile industry and many others. This situation is called the "Red Sea" , in analogy to fishermen along a crowded coastline competing for dwindling fish. In general, the Red Sea refers to a saturated market with fierce competition, populated by companies providing similar services or goods.

The opposite of the "red sea" is the "blue ocean" , which is an analogy to fishermen in a wide open blue ocean, with lots of fish and no competition . Generally speaking , the blue ocean refers to an untapped and uncontested market, offering little or no competition, since the market is not crowded. To create a blue ocean, you have to do something different from others, produce something that no one has seen before. The blue ocean strategy is a business strategy aimed at conquering uncontested market space, making competition unnecessary (Chan Kim and René Mauborgne 2005).

Specifically, blue ocean strategy allows a company to unilaterally change commonly adopted key elements of customer value to form a new set of customer values. This creates a new type of product or service, without competition. The following case study illustrates how the blue ocean strategy works.

Formulate a blue ocean strategy

Kim and Mauborgne noticed that many companies tend to adopt the following practices in their business practices:

- Define their own industry the way others define it and compete head-to-head to be the best.

- Stick to the strategic groups accepted by their sector, and strive to stand out in their strategic group.

- Focusing on the same group of buyers, whether they are buyers ( like the office equipment industry), retail customers (like the apparel industry), or influencers (like doctors for the pharmaceutical industry), although there are generally several levels of buyers.

- Define the scope of products and services offered by their industry in much the same way as their competitors do.

- Adopt similar customer value drivers as their competitors and set similar priorities for functional and psychological benefits.

- Focus on the same moment in time, and often on the current competitive threat.

These commonly adopted business practices are actually the main forces trapping businesses in the Red Sea. In order to get out of the red seas and into a blue ocean, you need to go beyond these business practices. However, stepping outside of currently accepted customer value drivers in a given industry is also risky. You can't arbitrarily abandon a set of well-established customer values and replace them with unknowns.

Based on many years of research and observation, Kim and Mauborgne proposed to formulate the blue ocean strategy by considering the following six aspects:

- Alternative industries

- Strategic groups

- Buyer groups

- Complementary product and service offerings

- Functional-emotional orientation

- Time

For a given industry, alternative industries are those industries that provide different forms of products or services serving the same purpose. For example, in a sense, restaurants and theaters offer very different types of products, but restaurants and theaters provide customers with enjoyable places and activities for their evening. Another example is tax filing: you can hire an accountant, do it yourself, or purchase tax filing software. These are very different choices, but they aim for the same goal.

Different industries within the same alternative industry class may have very different customer value drivers; for example, the customer value drivers of a restaurant are very different from those of a movie theater, and the customer value drivers of an accountant are very different from those of tax filing software. However, these alternative industries serve the same customer groups for the same or similar purposes. In this case, some crossover of the characteristics of these alternative industries can create new products or services that will be wildly successful.

Blue Ocean Case Study: American Wine Industry

The United States is the third largest consumer of wine in the world and the $20 billion wine industry is very competitive. California wines dominate the domestic market, capturing two-thirds of all U.S. wine sales. Californian wines compete with wines imported from France, Italy, Spain and South America. In recent years, many emerging wine producers have also emerged in areas such as Oregon, Washington, and New York. The number of wine brands continues to increase, but the overall market size remains stagnant, so the wine market becomes a typical "Red Sea" market. (Kim and Mauborgne 2005)

In the American wine market, almost all winemakers compete based on the following seven factors:

- Price per bottle of wine

- An elite, refined image in packaging, including labels announcing wine medals won and the use of esoteric wine terminology to emphasize the art and science of winemaking.

- Offline marketing to raise consumer awareness in a crowded market and encourage distributors and retailers to highlight a particular wine house

- Wine aging quality

- The prestige of the vineyard and its heritage (hence the appellations of estates and châteaux, and the references to the age of the establishment)

- The complexity and sophistication of a wine's taste, including elements such as tannins and oak

- A range of wines covering all grape varieties and consumer preferences from Chardonnay to Merlot and more.

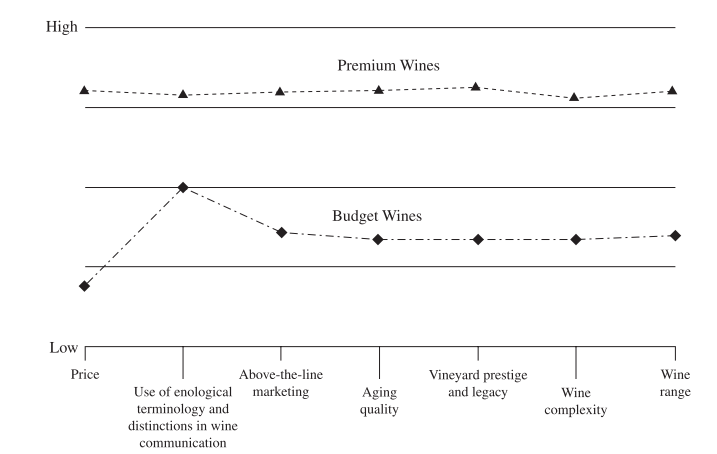

Based on these seven factors, Kim and Mauborgne analyzed the wine market and drew the graph shown in Figure 1.

Figure 1 : Value curves of the American wine market

The seven factors are represented on the horizontal axis and the vertical heights indicate the level or values of each factor. For example, premium wines have a higher “price” value than economy wines, meaning premium wines have a higher price. For other elements, such as "aging quality", the higher value of premium wines means that premium wines have higher aging quality than economy wines. Kim and Mauborgne (2005) call this graph “value curves” or “ strategy canvases.” »

It is easy to see that this value curve has many similarities with customer values. In the Kim and Mauborgne value curves, price is always the first element, and in a customer value analysis, price, and in the broader sense, the price profile perceived by the market, is also always a measure importance of customer value. In the Kim and Mauborgne value curves, factors other than price are always key competitive factors: they are very similar to the quality profile perceived by the market in customer value. We can call all these factors "value factors": price is always one of the value factors, and the other value factors are quality-related factors.

One of the differences between Kim and Mauborgne value curves and a customer value analysis is their graphical method. Figure 1 shows that although there are more than 1,600 wineries in the U.S. wine industry, most wines fall into one of two categories:

- wines have a high price, but also score well in the remaining six key value factors, so high-end wines are “high-quality and high-priced” wines;

- wines are cheaper, but also score lower in the other six key value factors, so economy wines are “low-priced, low-quality wines”.

The striking fact is that all wines compete directly on the same seven factors. Premium wines attempt to win by increasing quality scores, indicated by the six value factors (other than price). Increasing these qualitative aspects requires investment, thus increasing the cost, and to recover the cost, premium wines must be sold at a higher price. Economy wines sell at a lower price and to reduce production costs, the scores of the six value factors (other than price) will need to be lower. When the overall market size is limited, competition in one direction or the other is not very profitable and the growth potential is very low.

The key to a blue ocean strategy is to systematically modify these value drivers:

- What value factors that the industry takes for granted should be eliminated?

- Which value factors should be reduced well below the industry standard?

- What value factors should be raised well above industry standards?

- What value drivers should be created that the industry has never offered?

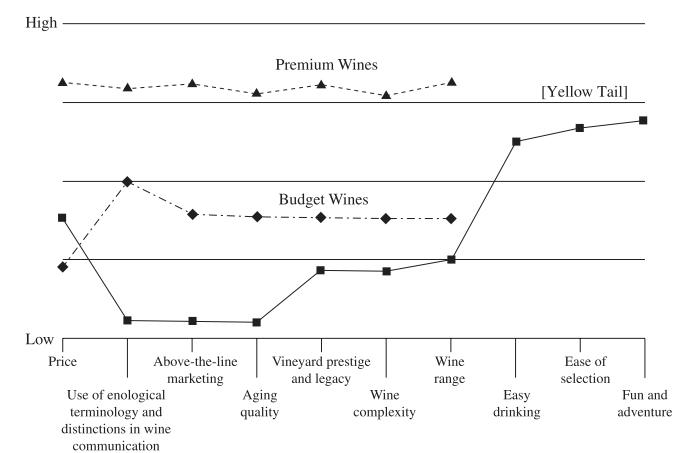

Casella Wines , an Australian winery, has noticed that almost all winemakers are focusing on prestige and traditionally accepted quality factors at their price points. However, Casella Wines noticed that alternative drinks to wine, such as beer, spirits and ready-to-drink cocktails, were three times the market for traditional wines. Casella also found that many American consumers think traditional wines are too complex, confusing and difficult to enjoy. These consumers believe that beer and ready-to-drink cocktails are sweeter and easier to drink. Based on careful analysis, Casella Wines has developed a brand new wine called Yellow Tail . Yellow Tail is a wine that features a new combination of viticultural characteristics that produces a simple wine structure. The wine is smooth in taste and accessible like the ready-to-drink cocktails and beers. The sweet fruitiness of the wine also keeps people's palates fresher, allowing them to enjoy another glass of wine without thinking about it. The result is an easy-drinking wine that doesn't require years of crafting. Consistent with this fruity sweetness, Yellow Tail has significantly reduced or eliminated all of the value factors that the wine industry had long competed on: tannins, oak, complexity and aging. Figure 2 illustrates the value curves of this new wine.

Figure 2 : Yellow Tail value curves

We can easily see that the value factors of Yellow Tail are very different from those of conventional wines. Three value factors for conventional wines – wine packaging, marketing and wine aging quality – are minimized; Three other value factors for conventional wines – vineyard prestige, wine complexity and wine range – are also reduced; and three completely new value factors are added – ease of consumption, ease of selection, fun and adventure – and they are positioned at a very high level.

Yellow Tail is a great success. Two years after its launch, it has become the fastest growing brand in the history of the United States and Australian wine industries, and it is the number one imported wine in the United States, surpassing wines from France and Italy. As of August 2003, it was the number one red wine in 750 ml bottles sold in the United States. Additionally, this occurred against the backdrop of a global wine glut.

Tail 's radical change in value factors created a social drink for everyone: beer drinkers, cocktail drinkers, and non-wine drinkers. This new wine works on different value factors and opens up a much wider market with very little competition. Thus, it created a blue ocean.

We can deduce the following observations:

- In a Red Sea market, each competitor offers a similar product or service with an almost identical set of value factors; the competition is face-to-face; each competitor offers either a high-priced, high-quality product or a low-cost, low-quality product; the market will soon be saturated; and profitability will be very marginal.

- Customer value systems can change over time, even for the same product or product class. The current customer value drivers that the industry competes with may have been established a long time ago, and customers may appreciate a change in these customer value drivers.

- If a producer adopts the right strategy to change customer value factors and develops a new set of customer value factors that match customer desires, the producer will create a blue ocean for its products with great potential for market growth and little competition.

Obviously, creating a blue ocean is like hitting a jackpot or a gold mine. In the economic literature, we can see many success stories resulting from bold changes in customer value drivers, but there are also many mistakes and failures due to poor decisions. How can you formulate the right changes in customer value drivers to create blue oceans, and are they even possible? Kim and Mauborgne proposed several ideas for systematically formulating blue ocean strategies by making the right changes to customer value drivers.